You will get more such blogs in an app named Finbloggers from various authors. You can download the app from

Que: What is the business of the company?

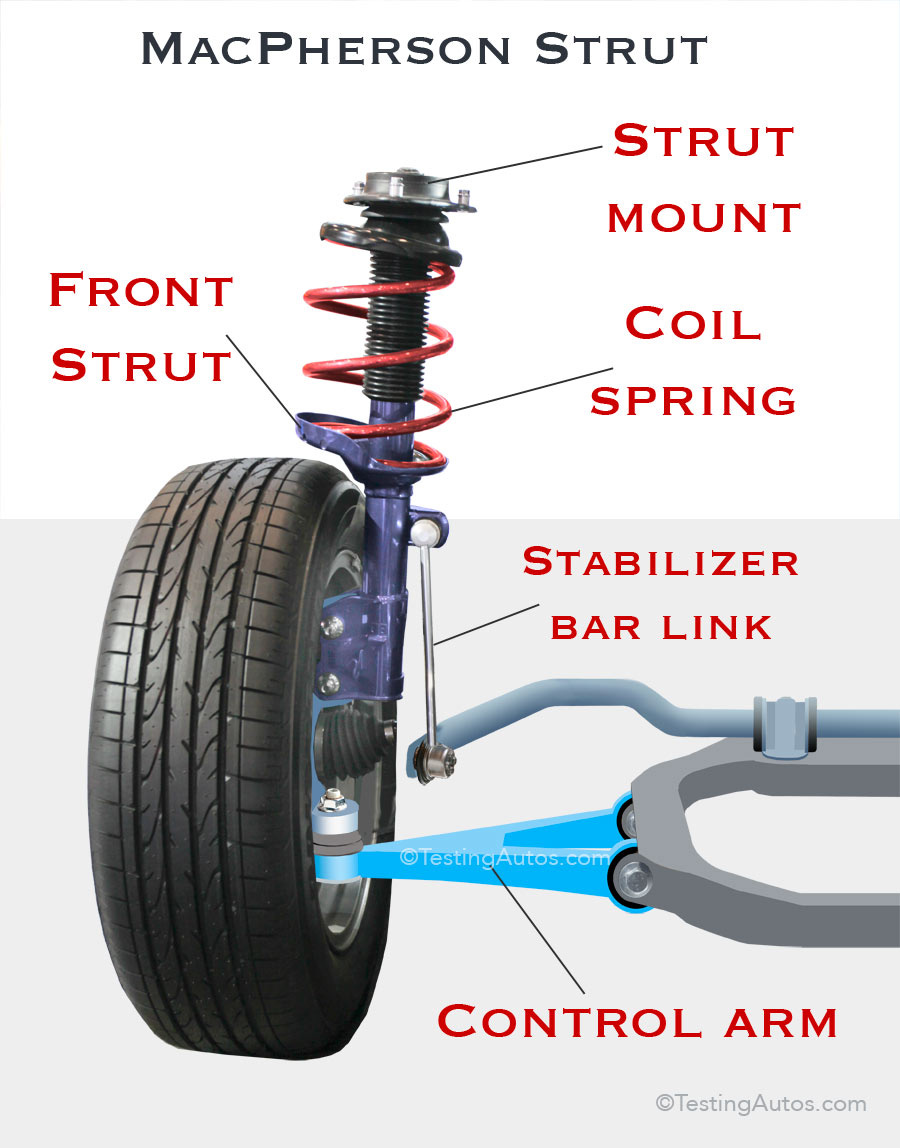

Ans: Gabriel is an auto ancillary company. It was established in 1961 by Deep C Anand in collaboration with Maremont Corporation, with initial operations in Mumbai. Over the years, the company has transitioned from a manufacturer of shock absorbers into a provider of the whole gamut of ride control and suspension products including axle dampers, front forks, strut assembly, cabin dampers, seat dampers, and dampers for EMU & LHB coaches as well as diesel locomotives.

Source: ICICI Report

Que: What is the use of the component made by Gabriel. Is there any threat to the business due to Electric Vehicles?

Ans :

Shock absorbers: A shock absorber or damper is a mechanical or hydraulic device designed to absorb and damp shock impulses. It does this by converting the kinetic energy of the shock into another form of energy (typically heat) which is then dissipated. Most shock absorbers are a form of dashpot (a damper which resists motion via viscous friction) - (2/3 W, PV, CV)

Struts: The struts are a structural component of most modern independent suspension systems and serve as a connection point between the wheel and the vehicle body. Structs are mainly for Passenger Vehicles and SUVs.

Front forks: This is one of the categories of shock absorber for 2W

To my knowledge, there is no threat to Electric Vehicles. Electric vehicles do require a shock absorber but it will be different from the conventional shock absorber. Conventional shock absorbers simply dissipate energy as heat. When used in an electric vehicle or hybrid electric vehicle the electricity generated by the shock absorber can be diverted to its powertrain to increase battery life.

Que: What is the revenue mix?

Source: https://tijorifinance.com/company/gabriel-india-limited#revenuemix

As you can see approx 70% of the customer comes from Two Wheelers Industry. Most of the auto ancillary depends directly on the cycle of auto Industries and Gabriel is no exception to it but demand has been slowly started picking due to favorable monsoon and several other factors including people avoiding going via public vehicles due to covid. It still needs to be seen the numbers posted by auto industries are the result of pent-up demand or actually it is the reversal of the cycle for auto Industries. If there is a reversal of cycle then Gabriel can be a good bet as it is least affected by EV disruption and available now at a discounted price.

Que: Who are the major competitor and what is the market share of Gabriel?

Ans

In two Wheelers :

Gabriel: 25% Market Share

Endurance Technologies

Munjal Showa :

In Passenger Vehicle major players are :

Gabriel: 15% Market Share

KYB

Monroe (Tenneco)

Rancho (Tenneco)

Showa

Bilstein

In Commerical-Vehicle Gabriel has 75% Market share

Source: Tijori

Let’s discuss business

Generally, the sale growth of Gabriel is directly linked to the success of the model to which Gabriel is supplying component but if we see the 10 years sales growth of Gabriel we get the comfort of almost consistent sales growth.

The market structure is oligopolistic in nature so it is highly unlikely that Gabriel can command premium PE.

Lowest PE it was available in past was around 5(2013) and the highest is 34(2017) currently it is trading at 34 PE but let’s not take current PE as a parameter because the situation is not normal due to covid, auto slowdown, BSIV transition, etc. if in 2020 the result would have been same like 2019 than now the PE might be 14 which is decent, not good not bad.

Almost all major OEMs are their client but expect less business from Hero and Bajaj as Hero business mostly goes to Munjal Showa and Bajaj give business to Endurance.

The operating margins are in the range of 7-9 % and Net profit margins are 5% this shows they don’t have much competitive advantage and OEMs don’t let them enjoy great margin.

Last year they did the expansion at the Sanand plant. This year plant was running at 92% of capacity before covid. This plant is responsible to deliver Front Fork to HMSI Scooter. The front fork has the highest margin.

AR -20 Highlights

Commence production for a new export order from Russia

Commenced manufacture of HMSI Scooter Front Fork by setting up a facility in Sanand

Developed high damping force technology products (with support of technology partner KONI) for the MBP platform of Ashok Leyland

Introduced new product lines like suspension parts, brake fluid, and driveshafts with 218 SKUs within the existing product lines

Compensation has been slightly increased even though sales and profits have gone down.

So In summary

An average business with a thin margin in an oligopolistic market.

No Competitive advantage

Valuation is low as the auto sector is in a down cycle

A ray of hope :

Deepening relation with Honda which can make revenue kind of stable as Endurance has Bajaj and Munjal has Hero, Gabriel we can assume have Honda, TVs, and Royal Enfield as their major clients.

Autocycle started to pickup

The company is looking/pushing towards aftermarket sales now 13% of revenue comes from aftermarket sales which is a good sign as it removes the dependency on OEMs and also contributes towards margin.

They are entering into Railway business but I am not expecting anything from this segment to contribute meaningfully in topline in the next 5 years if it does it will be a positive surprise.

Source: Screener

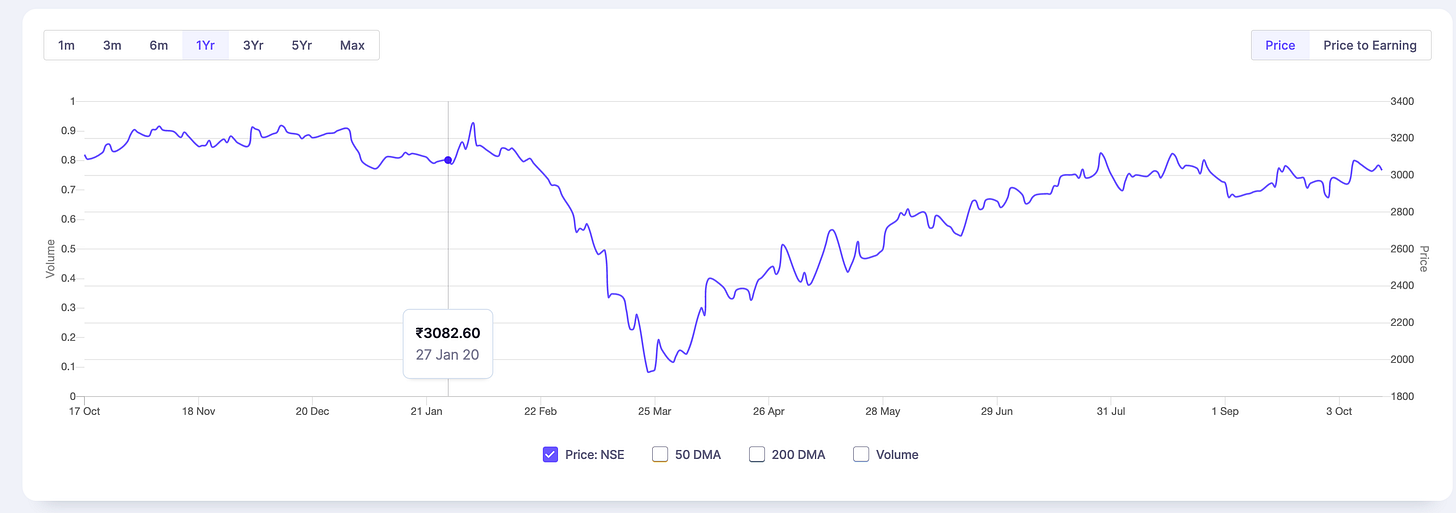

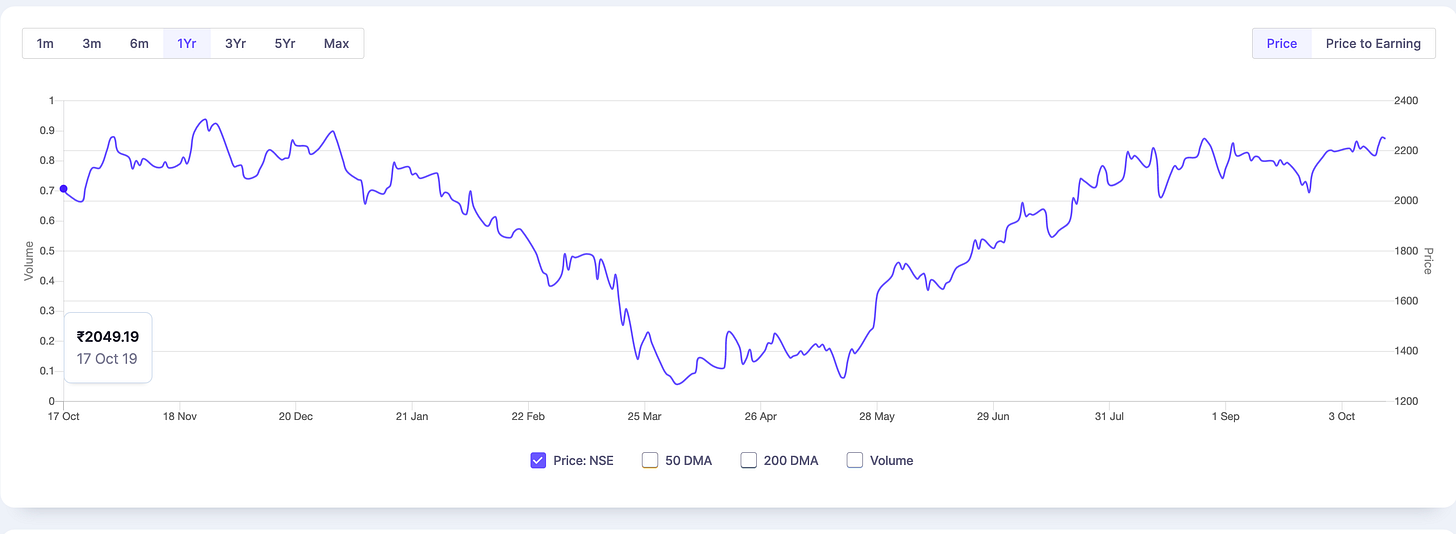

Hero Share Price

Bajaj Share Price

Eicher Share Price

Ashoka Leyland

Gabriel Share Price

The share price is not true picture as almost all good companies have been recovered from march lows (except ITC and Airtel :P) but just to give an indication of undervaluation Gabriel still has to reach to pre covid level - Stock Price-wise

Let’s discuss Risk

The major risk with the company is losing business to its competitor in forum value pickr I read it global players like KYB started making shock absorbers in 2015 any business loss to them can create permanent damage to Gabriel.

Let’s discuss Number

1) Company has increased sales and profit even though the auto is in a downcycle so this shows the resilience of the company in a bad time.

2) Proft Growth - 7-12%

3) OPM - 7 -10 %

4) Debt to equity is 0 - Excellent

5 Receivables days is around 50 which is Ok

6) Tax payout is consistently low - It is not Ok please let me know if anyone knows behind this are they enjoying any relaxation from govt like they have any plant which enjoys less taxable payout

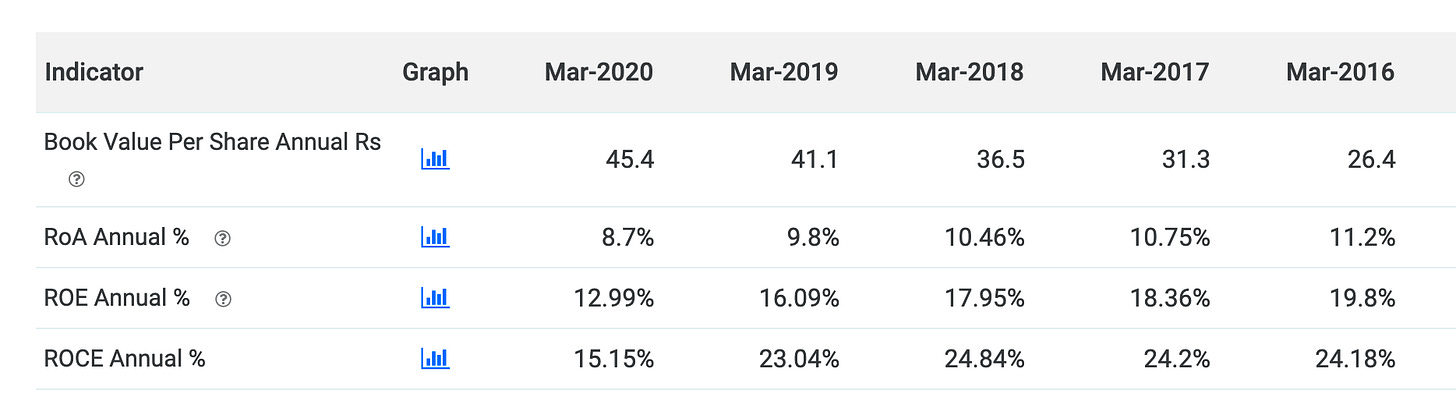

7) ROE and ROC are going down not a good sign but it can reverse with the reverse in the auto cycle

8) Company is a consistent dividend provider mostly 20-25% of profit which is a good thing.

Valuation lies in the eyes of a shareholder

For me, it is fairly valued at 100 if I consider Gabriel will grow 12% CAGR from here on and is undervalued if it will grow 20% from here on and if it grows in 5-10% CAGR than 80 is the fair value one should buy below fair value as it minimizes the risk of going wrong.

Note: This is not a recommendation I invested a little just for tracking purposes and I can sell anytime without informing anyone. I am not a SEBI Registered analyst please consult your advisor before investing.

You will get more such blogs in an app named Finbloggers from various authors. You can download the app from